Student loan debt in the United States is at about $1.7 trillion. Of course, student loan debt is not uniquely American – many other countries, such as the United Kingdom, Canada, and Australia, are also seeing significant increases in student debt. To better understand the situation, many universities, government agencies, lenders, and others are conducting student debt surveys. In this blog, we’ll look at who’s using these surveys and why, as well as how to create a student debt survey and the types of questions to consider asking.

Create your free student debt survey, form, or poll now!

Student Debt Numbers

Student debt in the United States is now the second highest consumer debt category, behind only mortgage debt. In fact, more money is owed in student loans than to credit cards and auto loans! — second only to mortgage debt and higher than debt for both credit cards and auto loans. While President Joe Biden recently tried to initiate a student loan forgiveness program, which would have canceled up to $20,000 in student debt for tens of millions of Americans, the conservative Supreme Court struck down the motion, saying that the president didn’t have the authority to instruct his Education secretary to cancel such a large amount of consumer debt without authorization from Congress.

Students and graduates in other countries are also struggling with student loan debt. Student loan debt has reached more than $250 billion in the UK, $100 billion in Australia, and $22 billion in Canada. While debt may not be as high in some other countries, many grads still struggle with finances.

Student Debt Challenges

The student loan debt situation can have a far reaching impact on the borrower and their family. Here are three key challenges facing those who take out student loans.

- Impact on Borrowers: The burden of student loan debt can have long-lasting effects on borrowers’ lives. It can delay major life milestones such as buying a home, getting married, starting a family, or pursuing higher education.

- Default Rates: The rate of student loan defaults has been a concern, particularly for borrowers who struggle to make their monthly payments. Defaulting on student loans can have severe consequences, including damage to credit scores and potential wage garnishment.

- Interest Rates and Repayment Terms: Student loans typically have both federal and private options. Federal loans generally offer more borrower protections and flexible repayment plans. Interest rates on federal loans are fixed, while private loans may have variable rates. Repayment terms can vary, with standard plans spanning ten years but extending up to 25 or 30 years for income-driven repayment plans.

How Are Student Debt Surveys Used?

To better understand the student debt crisis, surveys are often conducted. A student debt or student loan survey is a type of research study designed to collect data and gather insights about the experiences, opinions, and challenges related to student loans. Some common objectives of student debt surveys include:

- Assessing the level of student loan debt: Surveys can gather information about how much student loan debt an individual has racked up throughout their education.

- Understanding repayment experiences: Surveys may ask about the experiences of borrowers with regard to loan repayment, including the challenges they face and their strategies for managing debt.

- Identifying financial hardships: Researchers may use a financial survey to look into the ways student loan debt affects borrowers’ financial well-being, such as their ability to save, invest, or make major life decisions like buying a home or starting a family.

- Exploring loan forgiveness and assistance programs: Surveys may attempt to gauge awareness of loan forgiveness or assistance programs provided by the government or other organizations.

- Examining the impact on career choices: Researchers may ask about whether student loan debt influences graduates’ career decisions, such as taking higher-paying jobs over jobs that they are passionate about.

- Assessing the impact on mental health: Surveys may inquire about the psychological and emotional effects of carrying student loan debt, including stress and anxiety related to repayment.

The survey data collected can help policymakers, educators, and organizations better understand the challenges faced by borrowers and inform the development of potential solutions and policies related to student loans. Additionally, survey results can also be used to raise awareness about the issue and advocate for changes in the higher education financing system.

8 People and Entities That Use Student Debt Surveys

Student debt or student loan surveys are used by a number of different people and organizations. Here are eight entities that use student debt and loan surveys most often.

1. Government Agencies

Government agencies responsible for higher education, finance, and economic affairs often conduct student loan surveys to understand the scope of the student debt problem and assess the effectiveness of existing policies. Using this data, they can then determine potential changes or improvements to loan programs.

2. Educational Institutions

Colleges, universities, trade schools, and other educational institutions may conduct student loan surveys to better understand the financial well-being of their graduates and the loan repayment experiences of their alumni. This information can help them improve financial aid programs and inform incoming students about what they can expect when taking out student loans.

3. Non-profit Organizations

Nonprofits that focus on education, student advocacy, or financial literacy often use student loan surveys to advance their mission. They use the data to gain support for their advocacy efforts and to develop educational resources that can assist borrowers.

4. Financial Institutions

Banks, credit unions, and other financial lenders may conduct student loan surveys to better understand the borrowing habits of their customers and assess loan repayment trends. They can then tailor or adjust their financial products to better meet borrowers’ needs. They may also use surveys to determine whether applicants are viable candidates for student loans.

5. Employers

Some employers may offer student loan repayment plans (SLRPs). This benefit allows employers to make monthly contributions directly to an employee’s student loan servicer while employees continue to make regular payments. The monthly contribution can shave several years off each loan. Employers like the program as it differentiates them from their competitors as an employer of choice, and helps with recruitment and retention.

6. Research Institutes

Independent research organizations often conduct student loan surveys as part of broader research studies on student debt, higher education financing, and its societal implications. This helps them realize the scope of the student debt situation and provides valuable data to policymakers. These institutes may also conduct student loan surveys on behalf of clients, such as government agencies, financial institutions, or educational organizations, to gather data and insights for specific purposes.

7. Student Associations and Unions

Student organizations and unions represent the interest of their members. So, they may sometimes conduct student loan surveys to advocate for them. The results can be used to help raise awareness about student loan debt issues and initiate policy change at the government level

8. Mental Health Professionals

Student loan debt places a heavy financial strain on many borrowers. According to VeryWell, the strain of debt and its financial implications can cause poor mental health in some individuals. The organization says that “Student debt can take a serious toll on your mental health. Studies have linked student debt to lower levels of psychological well-being, regardless of income.”

Overall, student loan surveys play an important role in informing policymakers, educators, lenders, the public, and many others about the challenges and experiences faced by borrowers, shaping the discussion around student loan policies and helping identify potential solutions to alleviate the burden of student loan debt.

Student Debt Questions

Student debt surveys typically include a variety of questions designed to gather information about borrowers’ experiences, attitudes, and challenges related to student loans. The questions often vary based upon who, from our list of eight entities in the previous section, is conducting the survey. However, here are some common types of questions that may appear on student loan surveys following demographic questions (age, gender, ethnicity, education level, household income, and so on).

Student Loan Details:

- Total amount borrowed

- Types of loans (federal, private, etc.)

- Interest rates

- Current loan balance

- Repayment status (in school, grace period, repayment, deferment, etc.)

Loan Repayment Experiences:

- Monthly loan payment amount

- Ability to afford loan payments

- Use of repayment plans (e.g., income-driven repayment plans)

- Experience with loan deferment or forbearance

Financial Impact:

- Ability to save or invest due to loan obligations

- Impact of student loan debt on personal finances

- Ability to live independently/move from childhood home

- Effect on major life decisions (buying a home, starting a family, etc.)

Career Choices:

- Ability to find a desirable job after graduation

- Influence of student loan debt on career decisions

- Pursuit of higher-paying jobs for loan repayment purposes

- Availability of employer student loan repayment programs (SLRPs)

Loan Understanding:

- Awareness of loan terms and conditions

- Understanding of loan repayment options

- Knowledge of loan consolidation and refinancing

- Awareness of loan forgiveness programs

Emotional and Mental Health:

- Stress and anxiety related to student loan debt

- Impact on overall well-being

- Impact on family/significant other

Borrowing Habits and Financial Literacy:

- Decision-making process when taking out loans

- Understanding of interest rates and loan terms

- Knowledge of financial resources and budgeting

- Possession of good money management skills

Satisfaction with Loan Programs and Services:

- Satisfaction with loan providers

- Perception of borrower support and assistance

- Recommendations for better loan programs or policies

- Suggestions for reducing the burden of student loan debt

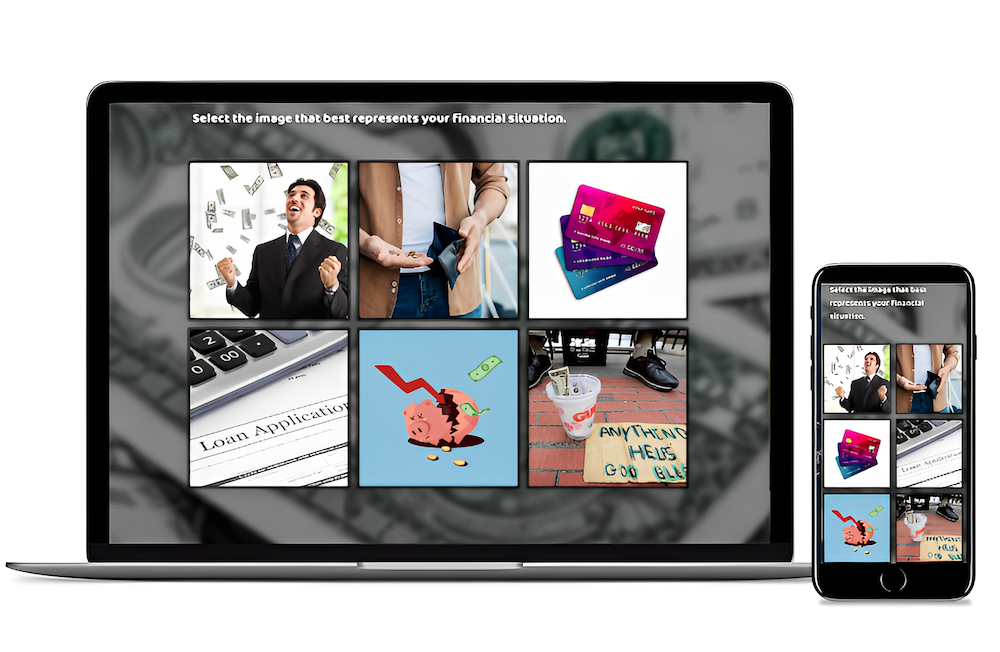

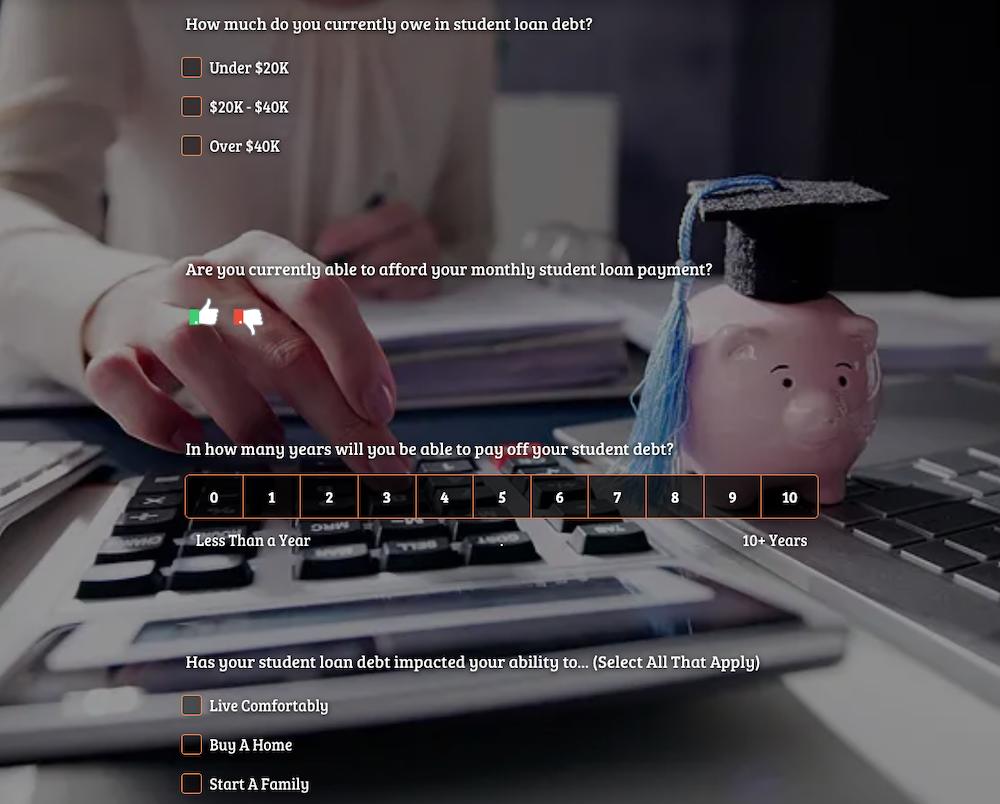

These types of student debt questions can easily be integrated into a SurveyLegend online survey. In the example below, we use a relevant survey image and a variety of questions (multiple choice, ratings, scales) to ask survey questions to improve engagement and response rates.

Conclusion

The student debt crisis in many countries is holding graduates back in terms of their ability to get ahead in the world. Burdened with debt, many borrows feel stuck – unable to move away from their parents, make major life purchases, or even pursue a career they’re passionate about. By conducting student debt surveys and student loan surveys, researchers can better understand the state of student debt and make changes to improve loan repayment options, mental health outcomes, and post-graduate life in general.

Ready to create your student debt survey? Start today with SurveyLegend. It’s easy to get started, and our surveys offer variety when it comes to questions types, design, and more. They’re also highly secure, so you can be sure respondents’ data remains safe and secure.

Have you conducted a student debt survey before? Which type of survey user from our examples are you? Let us know in the comments.

Create your free student debt survey, form, or poll now!

Frequently Asked Questions

Current debt statistics reveal that US student loans are at $1.7 trillion spread across approximately 45 million borrowers, making it the second most expensive type of consumer debt – greater than even credit card debt and auto loan debt.

These surveys are designed to capture a comprehensive view of borrowers’ experiences with student loans and the challenges they face during the borrowing and repayment process. The data collected from these surveys helps inform policymakers, educators, and other stakeholders about the impact of student loan debt and guides efforts to improve student loan programs and support systems.

Many people may use a student debt survey, including government agencies, educational, financial and research institutions, non-profit organizations and student associations, employers, and mental health experts.