Follow-up surveys are essential tools for gathering post-interaction feedback, enhancing customer satisfaction, and fostering stronger relationships. Whether used after a purchase, an event, or a service, these surveys help measure effectiveness, identify areas for improvement, and maintain customer engagement. Effective follow-up surveys are timely, relevant, and easy to complete—encouraging honest, actionable responses. By personalizing questions, keeping surveys concise, and offering clear value to respondents, organizations can boost participation and gain meaningful insights. Analyzing results from both quantitative and qualitative data helps refine processes, enhance experiences, and ensure continuous improvement for future interactions and events.

Create Your FREE Follow-Up Survey Now!

“The fortune is in the follow-up.”

– Jim Rohn

Rohn, an American entrepreneur, author, and motivational speaker who passed in 2009, understood the importance of follow-up. He would often talk about it during his seminars on setting goals and achieving success in life and business during the 1970s and 80s. Despite this, many studies – which we’ll highlight here – show that follow-up is often ignored or forgotten. So, let’s take another look at the importance of follow-up and how surveys can help with the process.

Rohn, an American entrepreneur, author, and motivational speaker who passed in 2009, understood the importance of follow-up. He would often talk about it during his seminars on setting goals and achieving success in life and business during the 1970s and 80s. Despite this, many studies – which we’ll highlight here – show that follow-up is often ignored or forgotten. So, let’s take another look at the importance of follow-up and how surveys can help with the process.

Follow-Up Definition

Following up, or follow-through, is the act of getting back to people, tasks, or commitments following an interaction or a promise. Whether it’s business or personal, a timely follow-up demonstrates reliability, professionalism, and a genuine interest in the outcome. Follow-up allows for clarification of details and resolution of issues. In sales, effective follow-up can significantly increase conversion rates and customer satisfaction. Ultimately, consistent follow-up not only builds trust and strengthens relationships but also ensures that goals are achieved and opportunities are capitalized upon.

Despite the benefits of following up, some people and businesses fail to consistently do so. Here are some surprising follow-up statistics, or should we say lack of follow-up statistics.

- 71% of qualified leads are never followed up with (Forbes)

- 80% of sales deals take five follow-ups, yet 44% of reps stop after one (Yesware)

- 53% of customers switch companies due to a lack of follow-up (Help Scout)

- 24% of job seekers don’t follow up with employers after an interview, although 68% of hiring managers appreciate a follow-up (APT)

- 70% of job seekers want feedback after an interview, but 75% of businesses ghost unwanted candidates following an interview (Tim Sackett Project)

- 57% of employees let communications about project updates slip through the cracks without proper follow-up (Hubspot)

Create Your FREE Follow-Up Survey Now!

What Is a Follow-up Survey?

A follow-up survey is a questionnaire administered after an initial interaction or event to gather feedback, assess satisfaction, or track progress. These surveys are often used in customer service, sales, event planning, employee feedback, and market research. Organizations may use different surveys, such as Net Promoter Score (NPS) surveys, post-event surveys, or training feedback forms, depending on their goals. The purpose of these surveys is to gather follow-up data and then to measure the effectiveness of actions taken, identify areas for improvement, and strengthen relationships with participants or customers. Collecting demographic information can help tailor future communications and better understand the characteristics of respondents.

Follow-up surveys can be conducted via various channels, including phone calls, mail-in surveys, or in-person interviews, but today most follow-up surveys are conducted online and often through email. The timing and accessibility of when you send surveys are important factors to maximize response rates. In fact, a HubSpot survey reveals that 80% of professionals prefer to use email for business communication, including follow-up.

10 Reasons to Use Follow-Up Survey

Here is a quick rundown of the various ways in which follow-up surveys benefit the sender and recipient in any transaction.

Following up…

- Provides closure, ensuring that tasks or commitments are resolved.

- Builds trust because it demonstrates reliability and commitment.

- Offer clarification, eliminating any possible misunderstandings or uncertainties.

- Provides feedback, which can be used to evaluate and improve future interactions or processes.

- Maintains momentum, ensuring ongoing initiatives remain in action.

- Improves customer experiences, showing them that their satisfaction is a priority, leading to increased loyalty and repeat business.

- Resolves problems, addressing issues or concerns before they escalate or damage reputations.

- Nurtures relationships, which can lead to future opportunities.

- Demonstrates professionalism, enhancing one’s reputation in both personal and professional spheres.

- Sets next steps, whether it’s setting up another meeting, finalizing a deal, and so on.

Create Your FREE Follow-Up Survey Now!

Target Audience

Identifying your target audience is a crucial first step in designing effective post-event surveys. The feedback you gather will only be as valuable as the relevance of your survey questions to those who experienced your event. Your target audience may include event attendees, speakers, sponsors, and even event staff—each group offering unique perspectives that can help you improve future events.

Understanding the demographics, interests, and preferences of your target audience allows you to craft survey questions that resonate and encourage honest, actionable feedback. For example, if your event attendees are primarily young professionals, you might include questions about networking opportunities or the use of event technology. If your audience consists of industry veterans, your event surveys could focus more on the depth of information presented or the quality of keynote speakers.

Tailoring your post-event surveys to the right audience ensures you collect feedback that is both meaningful and actionable. This approach not only increases response rates but also provides valuable feedback that can directly inform the planning of future events. By keeping your target audience in mind, you’ll be able to ask the right survey questions and gather insights that truly help you improve future events.

Follow-Up Survey Questions

The questions to ask on a follow-up survey will depend on the context of the interaction or event being evaluated. However, here are some general categories and examples of questions that can be included in a follow-up survey using a variety of types of survey questions, such as closed-ended questions, open-ended questions, Likert scale questions, rating scale questions, multiple choice, sliders, and more. Effective post-event survey questions and event survey questions should be carefully crafted to gather actionable feedback and improve future events. A well-designed survey question can provide both quantitative and qualitative insights, helping you measure ROI and attendee satisfaction. Using straightforward questions is essential to ensure clarity and encourage honest responses from participants.

Including a comment box in your survey allows respondents to provide additional feedback in their own words, offering valuable insights that may not be captured by other question types.

Create Your FREE Follow-Up Survey Now!

Overall Satisfaction

Assessing attendee satisfaction is a key goal of follow-up surveys, as it helps evaluate event success and identify areas for improvement.

- How satisfied were you with [company/product/event]?

- Did the event meet your expectations based on pre-event communication and marketing?

- On a scale of 1 to 10, how likely are you to recommend [company/product/event] to others? (This is commonly known as a Net Promoter Score question, which helps measure attendee loyalty and predict future growth.)

- How likely are you to purchase/attend an event from us again in the future?

Specific Experience

Questions can be tailored to assess the overall event experience, including both in-person and virtual events. For example:

- How would you rate the quality of [specific feature/service]?

- Were your expectations met regarding [specific aspect]?

- Would you say this product/event was [better/worse/about the same] as others you’ve tried/attended?

- How would you rate the keynote speaker’s presentation and impact on your overall event experience?

- If you attended virtually, how would you rate your virtual event experience compared to in-person events?

Feedback on Process

- How easy was it to [complete a task, make a purchase, attend the event]?

- Were there any obstacles or challenges you encountered during the process?

- On a scale of 1-10, how easily were you able to navigate our website?

Suggestions for Improvement

- What improvements would you suggest for [company/product/event]? It’s important to encourage both constructive feedback and negative feedback to identify areas for improvement.

- Is there anything we could do differently to better meet your needs?

- Did you communicate any concerns about the [product/service/event] to someone previously?

Note: Allowing respondents to answer in their own words can provide deeper insights and valuable qualitative feedback beyond just quantitative data.

Customer Service

- How would you rate the responsiveness and helpfulness of our customer service team?

- Did our team resolve any issues or concerns you had effectively?

- Is there anything else you would like to share about your experience?

These questions can be adapted and customized based on the specific goals of the follow-up survey and the audience being targeted. Remember to strike a balance between gathering valuable feedback and keeping the survey concise and easy to complete.

Create Your FREE Follow-Up Survey Now!

7 Follow-Up Survey Best Practices

Whether customers like follow-up surveys can vary depending on several factors, including the timing, relevance, and perceived value of the survey. Collecting more responses leads to more insights, which can drive meaningful improvements. Here are seven considerations:

5.2 Timing

Send surveys promptly after the event and make them easily accessible, such as by providing direct links or QR codes. This approach can help you gather more responses.

5.6 Length of Survey

Keep the survey short—ideally 10 questions or fewer—to increase completion rates and encourage more participants to provide feedback.

At the end of the survey process, follow-up communication is important to share results and next steps with stakeholders, ensuring continued engagement and collaboration.

1. Personalization

You may choose to use a person’s name in your subject line or email if you know it, although this is becoming more and more common. Another tactic is to mention the product, service, event, or topic, so that the recipient has a reference point. For example, you may title your subject line as follows:

- Quick survey about your [New iPhone X].

- How did you enjoy the [Manhattan Tech Conference]?

- Following up regarding your [BMW 525i] service repair.

2. Timing

Customers are more likely to appreciate follow-up surveys if they are conducted shortly after their interaction with a product or service (plus, the interaction will be fresh in their mind so you’ll receive better feedback). Sending a survey too long after the experience may result in reduced response rates or less accurate feedback.

3. Relevance

Customers are more likely to engage with surveys that are relevant to their experience. For example, a follow-up survey about a recent purchase or customer service interaction is more likely to be welcomed than a generic survey unrelated to their recent activities.

4. Perceived Value

Customers are more likely to participate in surveys if they believe their feedback will be used to improve products or services. If customers see tangible changes or improvements resulting from previous surveys, they may be more inclined to participate in future surveys. This is why it is important to act upon feedback, and not just request it and disregard it.

Create Your FREE Follow-Up Survey Now!

5. Ease of Participation

Customers appreciate surveys that are easy to complete and don’t require a significant time investment. This is one reason online surveys are so popular; people can take the survey when it is convenient for them, versus a phone survey, which may interrupt them when they are busy or an in-person interview, which may require travel (and incentives).

6. Length of Survey

Lengthy or overly complex surveys may deter participation. You might even consider microsurveys, which are gaining in popularity, or social media surveys, which lend themselves to brevity.

7. Incentives

Offering incentives such as discounts, coupons, or entry into a prize draw can increase participation in follow-up surveys. Be sure to read our blog on the 10 Pros & Cons of Survey Incentives to understand when to use them, when to avoid them, what to offer, and how to manage them.

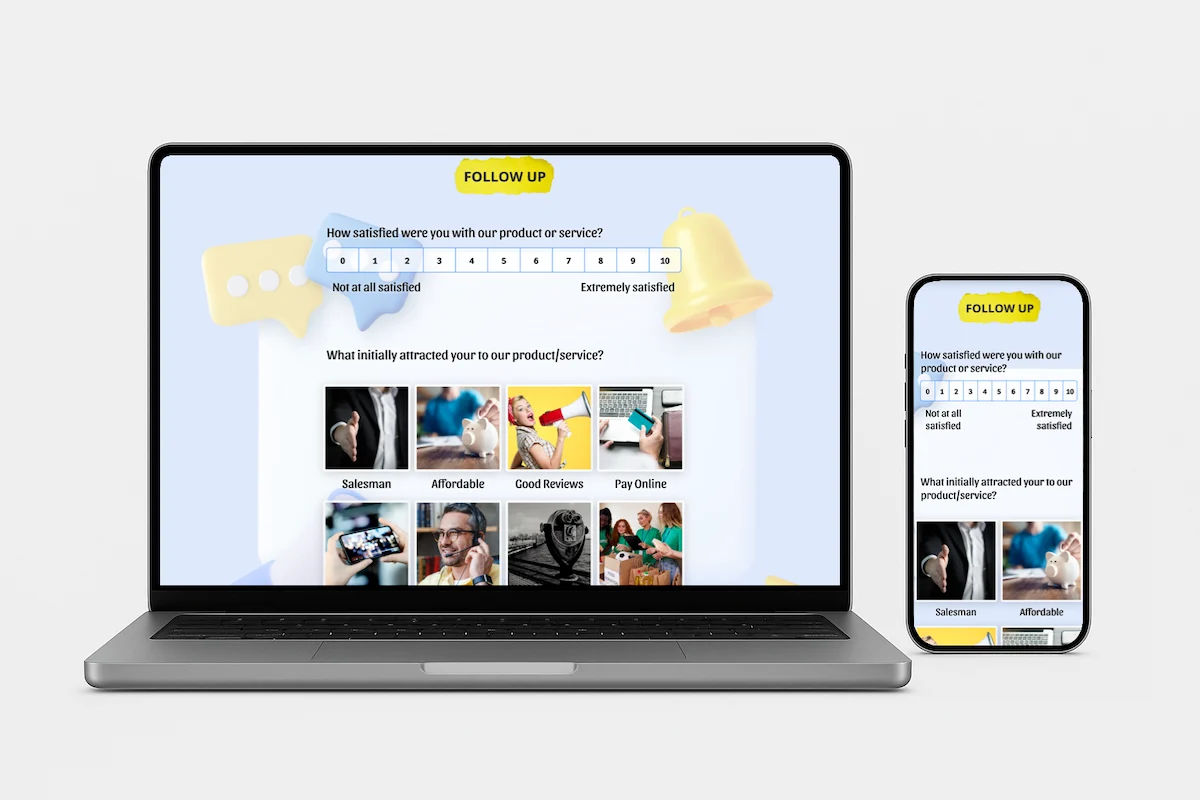

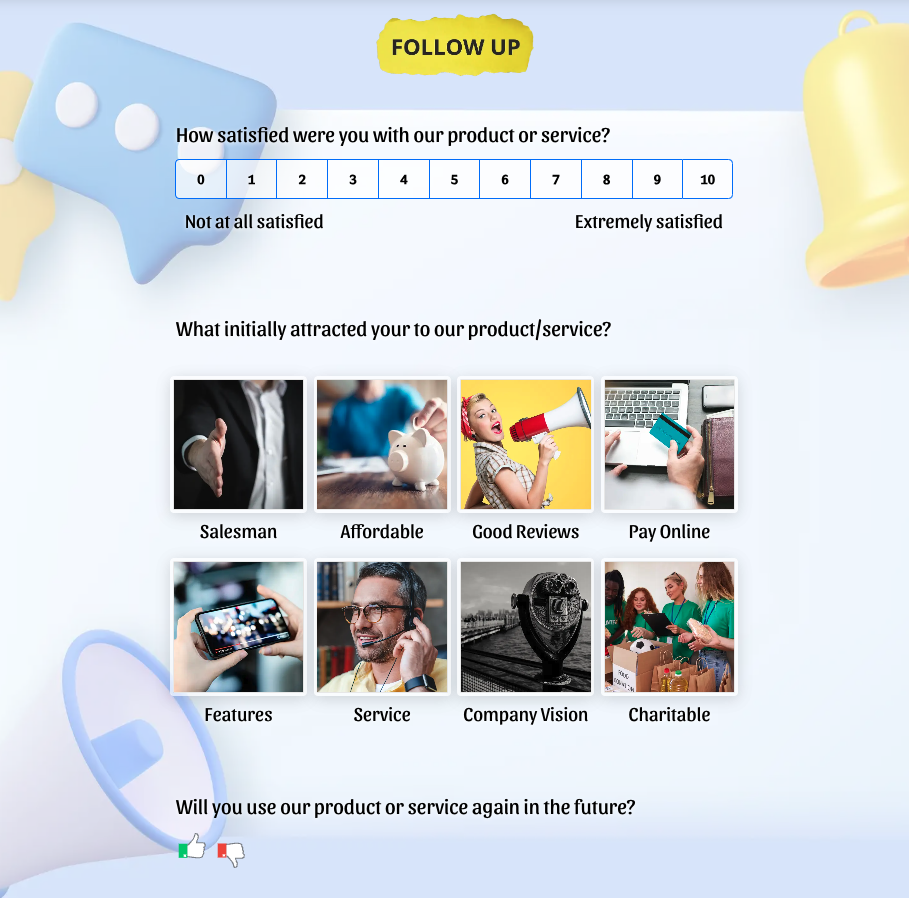

Follow-Up Survey Best Example

Below is a simple example of a follow-up survey created using SurveyLegend. It uses three types of questions to keep respondents engaged (scale, image selection, and thumbs), using “Follow Up” branding at the top, and employs an appropriate background image for eye appeal.

Follow-up surveys like this can be used in a variety of contexts, such as training courses, corporate events, and future conferences, to gather valuable feedback and improve future planning.

After collecting responses, analyzing the results can provide actionable insights to enhance future initiatives and increase attendee satisfaction.

Create Your FREE Follow-Up Survey Now!

Analyzing Survey Results

Once you’ve collected responses from your post-event survey, the next step is to analyze the survey results to uncover valuable insights. This process involves looking at both quantitative data—such as rating scale questions, percentages, and net promoter scores—and qualitative data from open-ended questions and comment boxes.

Quantitative analysis helps you quickly identify trends and measure overall satisfaction. For example, if a large percentage of event attendees rate the registration process highly, you know that aspect of your event is working well. On the other hand, if the majority of respondents give low scores to event logistics, it’s a clear signal that improvements are needed for your next event.

Qualitative analysis dives deeper into the feedback, allowing you to understand the reasons behind the numbers. Reviewing open-ended responses can reveal specific pain points, highlight memorable moments, or suggest new ideas for future events. For instance, if several attendees mention that the networking opportunities were limited, you can prioritize enhancing this aspect for your next event.

By thoroughly analyzing your post-event survey data, you can make informed decisions that lead to better planning and execution of future events. This ensures that each event builds on the successes and lessons of the last, continually improving the experience for your target audience.

Common Mistakes to Avoid

Creating effective post-event surveys requires careful planning to avoid common pitfalls that can undermine your efforts to gather valuable insights. One frequent mistake is overwhelming respondents with too many survey questions or including questions that aren’t relevant to the event or your target audience. This can lead to survey fatigue, resulting in fewer and less thoughtful responses.

Create Your FREE Follow-Up Survey Now!

Another common error is failing to provide clear instructions or context for your survey questions. Without proper guidance, respondents may misinterpret questions, leading to inaccurate survey data. Timing is also critical—sending your post-event survey too soon may catch attendees before they’ve had time to reflect, while waiting too long can result in faded memories and lower response rates.

Additionally, neglecting mobile optimization can significantly reduce participation, as many event attendees prefer to complete surveys on their smartphones. To improve future events, ensure your event surveys are concise, easy to navigate, and tailored to the needs of your target audience. Using features like conditional logic can help keep surveys short and relevant by only showing questions that apply to each respondent.

By avoiding these common mistakes, you’ll create post-event surveys that yield valuable insights, helping you make data-driven decisions and continually enhance the attendee experience at your future events.

Conclusion

Follow-through is an important part of life, and in business, it can make or break you. Whether you’re selling a product or service, putting on an event, or seeking feedback from employees, students, or any other group, it’s important to always follow up. With SurveyLegend, you can create your follow-up surveys for free using our awesome online survey tool. Our surveys are user-friendly, visually engaging, and highly secure. We also provide a wide variety of types of survey questions so you can make surveys that people will enjoy taking! Start today!

Have you sent follow-up surveys in the past? Do you appreciate receiving follow-up surveys? Why or why not? Let us know what you think in the comments!

Create Your FREE Follow-Up Survey Now!

Frequently Asked Questions

Why is follow-up important?

Following up is crucial in building and maintaining relationships, as it shows that you value the connection and are committed to staying engaged. It also helps to ensure that tasks or commitments are completed promptly and avoid any miscommunication or misunderstandings. A lack of follow-through can give the impression that someone doesn’t care about an interaction. Additionally, follow-up surveys can provide data that is essential for planning future events and improving outcomes.

When should you use follow-up surveys?

Follow-up surveys can be useful in a variety of situations; basically, anytime you need feedback from customers or users to improve your products, services, or processes. For example, after someone has completed the purchase of a product or service, after someone has attended an event, after a training session, or after launching a new product or feature. Survey responses can also be used to measure event ROI and guide strategic decisions.

Do people like follow-up surveys?

Some people may appreciate follow-up surveys, as they allow them to provide feedback and suggest improvements. Including follow-up questions in surveys can help organizations gather more detailed feedback and address specific concerns. Others may find them tedious and intrusive, especially if they are frequent or if they don’t see any tangible changes implemented as a result of their feedback. Overall, attitudes towards follow-up surveys may vary depending on individual preferences and experiences.