Homebuyer and home seller surveys help real estate professionals, lenders, developers, and policymakers better understand market behavior, preferences, and challenges in a tight housing market. Unlike property inspections, these surveys gather opinions and feedback to inform pricing, design, marketing, and policy decisions. Homebuyer surveys are used more often, as buyers represent the largest audience, and help uncover priorities like budget, location, amenities, and financing readiness. Seller surveys provide insight into pricing strategies, marketing effectiveness, and selling challenges. While surveys offer scalable, cost-effective insights and help build trust with buyers, poor design can lead to bias, survey fatigue, or low participation. When done well, they save time, improve targeting, and support smarter real estate decisions.

Create Your FREE Homebuyer or Seller Survey Now!

They say “Home Is Where The Heart Is,” but without a homebuyer survey, it can be difficult to understand just what type of property may tickle a potential buyer’s fancy. Of course, the housing market has been a challenge across much of the globe lately, with home transaction activity staying relatively flat in 2024. To better understand what’s going on and where buyers and sellers are at, many banks, lenders, developers, and Realtors have been using homebuyer surveys and home seller surveys. While banks or mortgage lenders may recommend certain surveyors, it’s wise for buyers to compare independent surveyors to ensure better value and services tailored to their needs. In this blog, we examine how these real estate questionnaires function and the advantages of utilizing them.

Investing in a homebuyer survey, which can start from a few hundred pounds, is a smart way to protect the significant amount of money spent on a property.

Create Your FREE Homebuyer or Seller Survey Now!

Introduction to Property Surveys

A property survey is an essential part of the home-buying process, giving buyers the detailed information they need to make confident decisions about a property purchase. Unlike a glance or a simple walk-through, a property survey provides a thorough assessment of the property’s condition, highlighting any potential issues that could affect your investment. Engaging a property surveyor early in the buying process can help you avoid unexpected costs and ensure you know exactly what you’re buying. In the UK, chartered surveyors—regulated by the Royal Institution of Chartered Surveyors (RICS)—are recognized for their expertise and professionalism. By hiring a qualified surveyor, buyers gain access to expert advice and a comprehensive survey report, making the home-buying process smoother and more transparent. Whether you’re a first-time buyer or a seasoned investor, a property survey is a smart step to protect your interests and your future home.

Create Your FREE Homebuyer or Seller Survey Now!

The Housing Market Today

In 2024, high mortgage rates and limited housing inventory strained affordability in many regions. In the United States, for example, average 30-year mortgage rates hovered above 6%, while home prices remained high due to persistent inventory shortages. This affordability crisis discouraged many first-time buyers, pushing some to explore single-family rentals as an alternative. Globally, economic uncertainty and inflation also impacted housing demand. In Europe, similar affordability issues exist, particularly in urban hubs, though some markets benefit from stabilizing inflation and government policies aimed at improving affordability. In emerging markets, population growth and urbanization drove demand, but rising construction costs posed barriers. While these same issues will linger in 2025, easing mortgage rates could bring relief to buyers, potentially increasing sales and improving affordability.

Create Your FREE Homebuyer or Seller Survey Now!

Types of Surveys

When it comes to property surveys, there are several options to suit different needs and budgets. The RICS Home Survey is a popular choice, offering a standardized approach to assessing a property’s condition. This survey comes in three levels: Level 1, Level 2, and Level 3. A Level 1 survey, also known as a condition report, provides a basic overview of the property’s state, highlighting any urgent defects but without extensive detail. The Level 2 survey, often called a homebuyer report, offers a more detailed survey, including advice on repairs and ongoing maintenance required. For those seeking the most comprehensive assessment, the Level 3 building survey delivers an in-depth inspection of the property, covering all the features, structural elements, and potential issues—ideal for older or unusual properties, or those in poor condition.

Create Your FREE Homebuyer or Seller Survey Now!

It’s important to note that a mortgage valuation, which is often required by your mortgage lender, is not the same as a full property survey. A mortgage valuation simply assesses the property’s market value for lending purposes and may not uncover problems that could affect your decision to buy. For peace of mind, always consider a full RICS home survey or building survey to get a complete picture of the property’s condition before you commit to a purchase.

Differences Between Home Buying & Selling Surveys

For this blog, we’re not talking about home survey inspections, in which a qualified surveyor identifies potential problems with a home during the selling or buying process. These are differences between home-buying and home-selling surveys, however. A home buying survey provides valuable data that influences marketing, sales strategies, and policy development across the real estate ecosystem. A home-selling survey is designed to gather feedback, opinions, or data from homeowners, buyers, or real estate agents about the process of selling a home. Because buyers represent the larger audience in real estate transactions, home-buying surveys are generally used more frequently than home-selling surveys/ The professionals who use these real estate tools want to focus heavily on understanding buyer needs, preferences, and behaviors to align listings with demand. Understanding buyers also helps professionals involved in the transaction to tailor their strategies, such as pricing, staging, and marketing, to buyer needs. Surveys can also reveal trends in what buyers prioritize, like energy efficiency or proximity to amenities. Lastly, real estate agencies frequently use buyer feedback to evaluate and improve their services, such as the quality of listings, the showing process, and negotiation practices.

Create Your FREE Homebuyer or Seller Survey Now!

The Role of a Property Surveyor

A property surveyor is a key ally in the home-buying process, offering expert guidance and a trained eye to spot issues that might escape the untrained eye. Chartered surveyors are highly qualified professionals who conduct a thorough visual inspection of the property, examining major indoor features, permanent outdoor buildings, and the surrounding grounds. Their role is to assess the property’s condition, identify any structural problems, and flag potential issues that could require attention now or in the future.

Create Your FREE Homebuyer or Seller Survey Now!

Beyond simply pointing out defects, a property surveyor provides practical advice on future repairs, ongoing maintenance, and any specialist attention that may be needed. They can also supply a market valuation and an insurance reinstatement figure, which are valuable for both negotiating the purchase price and for insurance purposes. By relying on a property surveyor’s detailed report, buyers can make informed decisions, budget for future costs, and avoid unpleasant surprises after moving in. In short, a good surveyor helps ensure your property purchase is a sound investment—giving you confidence and clarity throughout the home buying process.

7 Users Of Homebuyer Surveys And Why They Use Them

Here’s a look at who typically uses these homebuyer (and to a lesser extent, home selling) surveys:

Create Your FREE Homebuyer or Seller Survey Now!

1. Real Estate Agents and Agencies

Agents and agencies use these real estate surveys to understand buyer and seller preferences, priorities, and budget constraints. Based on what they learn from a Realtor survey, they can tailor property recommendations and improve client services.

2. Property Developers

Planners and builders will use real estate developer surveys to assess market demand for specific property types, features, and locations. This helps to inform design, amenities, and pricing strategies for new developments.

Create Your FREE Homebuyer or Seller Survey Now!

3. Mortgage Lenders and Financial Institutions

Lenders and others in the financial world use these surveys to evaluate buyer readiness and preferences for financing options. Based on the feedback, they will then develop mortgage products that cater to buyer needs.

4. Market Research Firms

Researchers will use the results of these surveys to analyze trends in home buying and selling behavior to identify emerging market opportunities. The reports they generate can be supplied to, or sold to, industry stakeholders or policymakers.

Create Your FREE Homebuyer or Seller Survey Now!

5. Government and Housing Authorities

The government and housing authority will turn to home-buying surveys in order to gather data for housing policies, affordability programs, and urban planning. This helps to shape initiatives that address housing shortages and affordability challenges.

6. Online Real Estate Platforms

To enhance user experiences, online platforms will use surveys to tailor property suggestions based on responses. Often, they will simply feed the data into AI-driven recommendation systems so that buyers can easily find what they need.

Create Your FREE Homebuyer or Seller Survey Now!

7. Individual Homebuyers and Sellers

Surprise! The homebuyer or home seller may use the surveys themselves! These often come in the form of self-assessment tools offered by agencies or websites to assist in their decision-making.

Pros & Cons Of Using Homebuyer Surveys

Using a homebuyer survey is almost always beneficial for gaining insight. A homebuyer survey can uncover major faults in a property, such as structural issues or damp, and may recommend further investigation if the surveyor cannot fully assess certain areas. Surveys provide a detailed understanding of the property’s condition, and allow buyers to raise particular concerns with the surveyor to ensure these are addressed. While pros outweigh cons in most cases, there are some issues that surveyors should be aware of when using them.

Create Your FREE Homebuyer or Seller Survey Now!

Pros:

A survey uncovers issues that may not be visible to the untrained eye, helping buyers make informed decisions.

Of Using Homebuyer Surveys

Surveys offer many benefits for those in the home-buying market. Most online surveys, like those offered by SurveyLegend, are customizable and scalable. They can be easily adapted for different audiences or property types. Plus, delivering them online (via email, text, or social) allows for wide distribution, which is ideal as some potential buyers could be from out of state or even out of the country. This allows survey users to reach more buyers at a low cost.

As already mentioned, home buying surveys give industry professionals a better understanding of buyer needs. They provide detailed insights into what buyers are looking for in a property. They also allow real estate professionals or developers to tailor offerings to align with demand, and can help inform marketing campaigns, leading to more efficient lead generation.

Create Your FREE Homebuyer or Seller Survey Now!

Finally, when it comes time to buy, the surveys may have already identified challenges or obstacles, which can be eliminated to provide better service and a focus on properties that match the buyer’s preferences, saving valuable time. And, by engaging buyers in the process, professionals can build trust and rapport, which any Realtor will tell you is key to making a deal.

Cons of a Homebuyer Survey

Any negatives associated with home-buying surveys generally are due to poor survey design. For example, questions may not be worded well, leading respondents to provide vague or inaccurate answers. Poorly designed surveys can also lead to survey fatigue, which discourages participation and results in low response rates. Read more about survey fatigue in our blog “What Is Survey Fatigue & 10 Ways To Combat It.”

Survey bias can also hinder results. For example, buyers may be tempted to give socially desirable answers rather than their true preferences (for example, stating that they are open to purchasing a home in a less desirable neighborhood when in actuality they would not consider it, or saying they’re open to spending $500K when in reality their budget is only about half of that).

Read more in our blog “Different Types of Survey Bias & How To Avoid Them.”

Create Your FREE Homebuyer or Seller Survey Now!

Finally, online home buying surveys are dependent on “digital literacy.” While younger generations are technically savvy, they’re also less likely to be buying homes right now due to limited finances. On the other hand, older buyers with the financial means who may be downsizing once the children have moved out may be less comfortable with digital platforms. Learn more about generational differences and their impact on survey participation.

Homebuyer Survey Questions

Here’s a look at some survey questions to consider including on a homebuyer survey. A house survey can help buyers assess the condition of a house, including features like a septic tank or the use of common building materials. Some questions may also be useful to ask the seller directly to clarify repairs or outstanding issues. Want more ideas? Check out our blog “24 Questions For Real Estate Surveys.”

Homebuyer Property Preferences:

- What type of property are you looking for?

- How many bedrooms and bathrooms do you need?

- Do you require a backyard or pool?

Create Your FREE Homebuyer or Seller Survey Now!

Location Factors:

- Do you prefer urban, suburban, or rural locations?

- How important is proximity to schools, work, or public transport?

- Do you have specific neighborhoods in mind?

Budget and Financing:

- What is your budget for purchasing a property?

- Are you pre-approved for a mortgage?

- How much of a down payment can you put down?

Decision Influences:

- Are you planning to buy a move-in-ready property or one that needs renovation?

- Are you open to a Home Owner’s Association (HOA) membership?

- Do you have insurance concerns based on the areas you’re looking at?

Create Your FREE Homebuyer or Seller Survey Now!

Experience and Challenges:

- Have you faced any difficulties in your home search?

- How would you rate your experience with real estate agents or property listings?

- How was the lending process?

Miscellaneous (After Purchase):

- What made the property you purchased appealing to you?

- Was the home accurately described in the listings?

- Have you discovered problems or issues with the home since closing?

- Did you ask the seller about any recent repairs, outstanding issues, or the condition of features such as the septic tank or common building materials used in the house?

Create Your FREE Homebuyer or Seller Survey Now!

Home Selling Survey Questions

General Information:

- What is your main reason for selling your home? (Relocation, downsizing, financial reasons, etc.)

- How did you determine the listing price for your home? (Comps, upgrades, etc.)

- Are you in a deed-restricted area?

Experience with Selling:

- Did you use a real estate agent or sell the property yourself? (Used an agent, sold independently, used an online service)

- How long did your home stay on the market before it sold?

- Did you get an acceptable number of offers with your current listing price?

Create Your FREE Homebuyer or Seller Survey Now!

Challenges Faced:

- What was the biggest challenge in selling? (Pricing, finding buyers, paperwork, etc.)

- Was staging or preparing your home for sale difficult?

- Was the appraisal process easy? How about the inspection process?

Marketing and Advertising:

- What methods were most effective in attracting buyers? (Online listings, open houses, word of mouth, etc.)

- Did you invest in professional photography?

- Did you consider hosting virtual tours online?

Satisfaction and Recommendations:

- How satisfied were you with the selling process? (Scale: 1–5)

- Would you recommend your agent/service to others?

- Would you recommend your mortgage company to others?

Create Your FREE Homebuyer or Seller Survey Now!

Homebuyer Survey Example

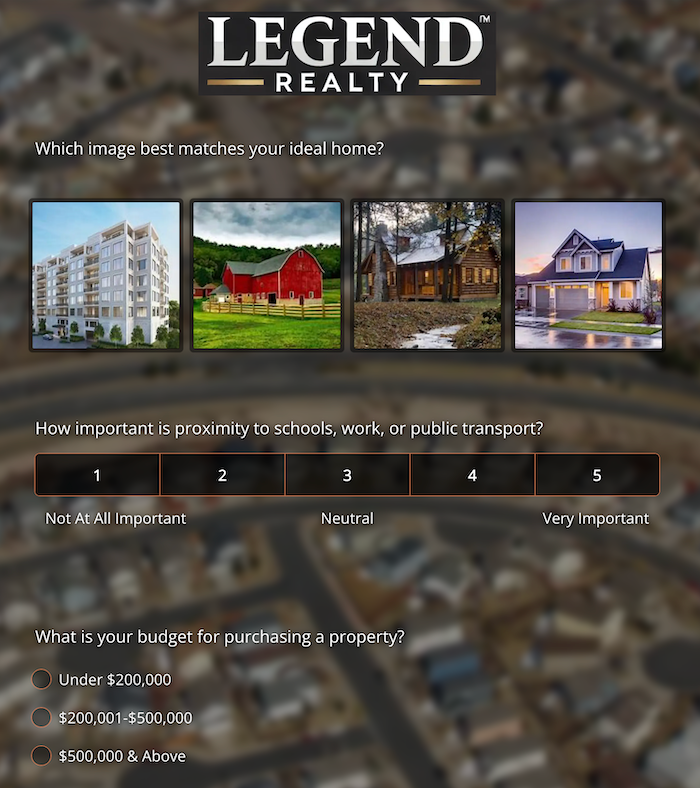

Here’s a look at a homebuying survey created using SurveyLegend. You’ll notice that we’ve used a variety of types of survey questions to keep the respondent engaged, have added a company logo to the top for authenticity, and used an appropriate home-buying image in the background.

Of course, this is just one example; with SurveyLegend, you have unlimited options and freedom! Read more in our blog “14 Different Types of Survey Questions With Examples.”

Conclusion

A real estate survey for buying or selling can be an excellent tool for gathering data and improving buyer-focused strategies. Of course, survey effectiveness depends on careful design, clear questions, and proper follow-up. Thankfully, SurveyLegend makes it all easy!

Our online surveys, whether used for market research, client feedback, or strategic planning, aid in the process of buying and selling homes. Our surveys are simple to create, offer a plethora of customization options, and provide robust analysis at the conclusion of the survey. They can also appear as professional, or as fun, as you like! Get started today for free!

Create Your FREE Homebuyer or Seller Survey Now!

Frequently Asked Questions (FAQs)

Why are home buyer surveys, as in questionnaires, valuable?

Such surveys are invaluable for refining the services offered to buyers, aligning property options with market demand, and smoothing the home-buying process.

Is a home survey a legal requirement?

In Scotland, having a home survey is a legal requirement when selling a property. In England and Wales, a home survey is not a legal requirement, but it is highly recommended to help buyers make informed decisions and avoid unexpected costs.

What are the different home survey levels, and which properties are suitable for each?

There are three main home survey levels, as classified by RICS: Level 1 (Condition Report), Level 2 (Home Buyers Survey), and Level 3 (Building Survey). Level 1 is suitable for properties in good condition and of conventional construction. Level 2, often called a home buyer’s survey, is suitable for homes in reasonable condition that are of standard design and have not been significantly altered. Level 3 is recommended for older, larger, or significantly modified properties, or those not in good condition.

What is a home buyer’s survey, and when is it a suitable option?

A home buyer’s survey is a detailed inspection suitable for conventional homes in reasonable or good condition. It provides a comprehensive assessment of the property’s condition, highlights potential repairs, and outlines maintenance considerations, making it ideal for most standard properties.

Why are home-selling surveys used less often than home-buying surveys?

Home-selling surveys are valuable for understanding seller challenges, evaluating agent performance, and refining marketing strategies. They’re often used internally by agencies to optimize how homes are listed and sold versus going out to the general public, making them less prolific than buyer surveys.

What are some tips for home-buying and selling surveys?

To maximize response rates and get the most accurate insights, keep your survey short and relevant. Always use clear, unbiased language, and consider offering incentives (like a market report) to encourage participation. Finally, supplement surveys with follow-up interviews for deeper insights.