Surveys are one of the most effective tools for gathering insights, understanding your audience, and making data-driven decisions. But not all surveys are created equal. With so many options available—ranging from traditional face-to-face interviews to cutting-edge AI surveys—it’s important to choose the right survey research methods based on your goals, audience, and resources.

In this comprehensive guide, we’ll walk you through 18 different types of survey methods, each with unique benefits and ideal use cases. Whether you’re conducting market research, collecting customer feedback, analyzing user behavior, or launching a new product, selecting the right survey format is critical for success.

From in-depth interviews and focus groups that deliver rich qualitative data to online surveys, mobile app surveys, and SMS polls that scale effortlessly in real-time, each method offers its strengths in data collection. We also explore innovative approaches like QR code surveys, pop-ups, embedded forms, and AI-driven chatbots, showing how today’s technology is reshaping the future of feedback.

Choosing the best survey method ensures your questions are heard and your insights are reliable. You’ll learn how to match your survey to your audience, improve response rates, and gather the kind of meaningful data that drives actionable outcomes.

So, if you’re asking, “What type of survey should I use?”—you’re in the right place. Explore our expert breakdown of modern and traditional survey types and find the perfect method for your next research initiative in this article.

Create your first survey, form, or poll now!

18 Different Types of Survey Methods

Different survey research methods serve different purposes, which is why there are a number of them to choose from. Choosing the right survey method and proper survey design is essential to meet specific research objectives, as these factors ensure that the data collected aligns with your goals and provides meaningful insights. “What are the types of surveys I should use?” you ask. Here’s a look at the 18 different survey types of survey methods researchers use today.

1. Interviews

Also known as in-person surveys or household surveys, this used to be one of the most popular types of surveys to conduct. Researchers like them because they involve getting face-to-face with individuals. Of course, this method of surveying may seem antiquated when today we have online surveying at our fingertips. However, interviews still serve a purpose.

Researchers conduct interviews when they want to discuss something personal with people. For example, they may have questions that may require extensive probing to uncover the truth. Interviews are particularly effective for collecting detailed feedback on sensitive or complex topics, as they allow respondents to elaborate on their experiences and opinions. Sure, some interviewees may be more comfortable answering questions confidentially behind a keyboard. However, a skilled interviewer is able to put them at ease and get genuine responses. They can often go deeper than you may be able to using other surveying methods.

Often, in-person interviews are recorded on camera. This way, an expert can review them afterward. They do this to determine if the answers given may be false based on an interviewee’s change in tone. A change in facial expressions and body movements may also be a signal they pick up on.

2. Intercept Surveys

While interviews tend to choose respondents and have controls in place, intercept surveys (or “man on the spot”) surveys are conducted at certain locations or events. This involves having an interviewer, or multiple interviewers, scoping out an area and asking people, generally at random, for their thoughts or viewpoints on a particular topic. Intercept surveys depend on the willingness of survey respondents to participate on the spot.

These are often used in high-traffic areas like malls, airports, or event venues. Intercept surveys are useful for capturing spontaneous reactions to real-world experiences. For instance, a retail store may conduct intercept surveys to gauge immediate impressions after a purchase. The random element ensures a mix of participants, offering a snapshot of the general public sentiment.

3. Focus Groups

These types of surveys are conducted in person as well. However, focus groups involve several people rather than just one individual. The group is generally small but demographically diverse and led by a moderator. The focus group may be sampling new products or having a discussion around a particular topic, often a hot-button one.

Focus groups are especially valuable for uncovering deep insights into participants’ attitudes and perceptions. The purpose of a focus group survey is often to gauge people’s reaction to a product in a group setting or to get people talking, interacting—and yes, arguing—with the moderator taking notes on the group’s behavior and attitudes. This is often the most expensive survey method as a trained moderator must be paid. In addition, locations must be secured, often in various cities, and participants must be heavily incentivized to show up. Gift cards in the $75-100 range for each survey participant are the norm.

4. Panel Sampling

Recruiting survey-takers from panel surveys, also known as panel sampling, maintained by a research company, is a surefire way to get respondents. A panel survey involves a pre-recruited group of respondents who participate in multiple surveys over time, making it useful for tracking changes and conducting longitudinal studies. Why? Because people have specifically signed up to take them. The benefit of these types of surveys for research, of course, is there you can be assured of responses. In addition, you can filter respondents by a variety of criteria to be sure you’re speaking with your target audience.

Create your first survey, form, or poll now!

The downside is data quality, which directly affects data collection. These individuals get survey offers frequently. So, they may rush through them to get their invention and move on to the next one. In addition, if you’re constantly tapping into the same people from the same panel, are you truly getting a representative sample?

5. Telephone Surveys

Most telephone survey research types are conducted through random digit dialing (RDD). RDD can reach both listed and unlisted numbers, improving sampling accuracy. Surveys are conducted by interviewers through computer-assisted telephone interviewing (CATI) software. CATI displays the questionnaire to the interviewer with a rotation of questions.

Telephone surveys (also known as phone surveys) started in the 1940s. In fact, in a recent blog, we recount how the predictions for the 1948 presidential election were completely wrong because of sampling bias in telephone surveys. Rising in popularity in the late 50s and early 60s when the telephone became common in most American households, telephone surveys are no longer a very popular method of conducting a survey. Why? Because many people refuse to take telephone surveys or simply do not answer calls from a number they don’t recognize, prompting a shift towards more frequent online surveys.

6. Post-Call Surveys

If a telephone survey is going to be conducted, today it is usually a post-call survey. This is often accomplished through IVR, or interactive voice response. IVR means there is no interviewer involved. Instead, customers record answers to pre-recorded questions using numbers on their touch-tone keypads. If a question is open-ended, the interviewee can respond by speaking, and the system records the answer. IVR surveys are often deployed to measure how a customer feels about a service they have just received. For example, after calling your bank, you may be asked to stay on the line to answer a series of questions about your experience. Post-call surveys can also be structured to collect detailed responses about customer service experiences, allowing organizations to gather more in-depth feedback from customers.

Most post-call surveys are either NPS surveys or customer satisfaction (CSAT) surveys. The former asks the customer, “How likely are you to recommend our organization to a friend or family based on your most recent interaction?” while the CSAT survey asks customers, “How satisfied are you with the results of your most recent interaction?”. NPS survey results reflect how the customer feels about the brand, while CSAT surveys are all about individual agent and contact center performance.

7. SMS Text Surveys

Many people rarely use their phones to talk anymore and ignore calls from unknown numbers. This has given rise to the SMS (Short Messaging Service) text survey. SMS surveys are delivered via text to people who have opted in to receive notifications from the sender. Respondents can quickly answer questions using their mobile devices, making the process fast and convenient. This means that there is usually some level of engagement, improving response rates. The one downside is that questions typically need to be short, and answers are generally 1-2 words or simply numbers (this is why many NPS surveys, gauging customer satisfaction, are often conducted via SMS text). Be careful not to send too many text surveys, as a person can opt-out just as easily, usually by texting STOP. For tips on timing, message length, and compliance, check out our guide on SMS text survey best practices.

They are particularly useful for reaching younger or mobile-first populations. Retailers, healthcare providers, and even governments use them for instant feedback, appointment confirmations, or health checks. Automation platforms can send timed follow-ups, increasing participation. However, message length and timing (e.g., avoiding late-night texts) are critical to avoid drop-offs.

8. Mail-in Surveys / Postal Surveys

These are delivered right to respondents’ doorsteps! Mail-in surveys, also known as mail surveys, are a type of paper survey. Mail surveys were frequently used before the advent of the internet, when respondents were spread out geographically and budgets were modest. After all, mail-in surveys didn’t require much cost other than the postage.

So are mail-in surveys going the way of the dinosaur? Not necessarily. As a form of paper surveys, they are still occasionally more valuable compared to other methods of surveying. Paper surveys are especially useful in areas with limited internet access or when targeting populations that are difficult to reach online, but they can present challenges such as higher data entry costs and slower processing times. Because they are going to a specific name and home address, they often feel more personalized. This personalization can prompt the recipient to complete the survey.

They’re also good for surveys of significant length. Most people have short attention spans and won’t spend more than a few minutes on the phone or filling out an online survey. At least, not without an incentive! However, with a mail-in survey, the person can complete it at their leisure. They can fill out some of it, set it aside, and then come back to it later. This gives mail-in surveys a relatively high response rate.

Create your first survey, form, or poll now!

9. Kiosk Surveys

These surveys happen on a computer screen at a physical location. A survey kiosk is an interactive touch-screen station used to collect feedback in public locations. You’ve probably seen them popping up in stores, hotel lobbies, hospitals, and office spaces. These days, they’re just about anywhere a researcher or marketer wants to collect data from customers or passers-by. Kiosk surveys provide immediate feedback following a purchase or an interaction. They collect responses while the experience is still fresh in the respondent’s mind. This makes their judgment more trustworthy. Below is an example of a SurveyLegend kiosk survey at McDonald’s. The kiosk survey collects information, thanks the respondent for their feedback, and then resets for the next customer. You can create your own kiosk survey here.

Kiosks can be tailored to languages, customer segments, or services offered at the location. Retailers and hospitals use them for compliance tracking, service rating, or facility cleanliness feedback. Some kiosks use facial recognition to monitor engagement levels, while others offer anonymity to encourage honesty. Maintenance and data syncing are crucial to avoid disruptions.

10. Email Surveys

Email surveys are one of the most effective surveying methods as they are delivered directly to your audience via their online account. Using a survey tool makes it easy to create surveys, streamlining both the creation and distribution process through email. They can be used by anyone for just about anything, and are easily customized for a particular audience. Another good thing about email surveys is you can easily see who did or did not open the survey and make improvements to it for a future send to increase response rates. You can also A/B test subject lines, imagery, and so on to see which is more effective. SurveyLegend offers dozens of different types of online survey questions, which we explore in our blog 12 Different Types of Survey Questions and When to Use Them (with Examples).

They are effective for B2B and B2C outreach. Email campaigns can be personalized using customer data (e.g., name, purchase history) for higher relevance. Email surveys integrate well with CRMs like Salesforce or HubSpot, enabling automatic triggers after certain actions—like purchases or support tickets—for timely feedback collection.

.

11. Pop-up Surveys

A pop-up survey is a feedback form that pops up on a website or app. Pop-up surveys are an effective way to distribute surveys to online audiences in real time, allowing you to reach users directly as they interact with your site or app. Although the main window a person is reading on their screen remains visible, it is temporarily disabled until a user interacts with the pop-up, either agreeing to leave feedback or closing out of it. The survey itself is typically about the company whose site or app the user is currently visiting (as opposed to an intercept survey, which is an invitation to take a survey hosted on a different site).

A pop-up survey attempts to grab website visitors’ attention in a variety of ways, popping up in the middle of the screen, moving in from the side, or covering the entire screen. While they can be intrusive, they also have many benefits. Read about the benefits of pop-up surveys here.

12. Embedded Surveys

The opposite of pop-up surveys, these surveys live directly on your website or another website of your choice. Embedded surveys are a convenient way to gather data from users directly on a website. Because the survey cannot be X’ed out of like a pop-up, it takes up valuable real estate on your site, or could be expensive to implement on someone else’s site. In addition, although the embedded survey is there at all times, it may not get the amount of attention a pop-up does since it’s not “in the respondent’s face.”

Embedded surveys are great for continuous data collection. For instance, universities often embed course feedback forms directly in their learning portals. While less intrusive, they must be visually integrated into the site layout to ensure usability. A good practice is to combine them with incentives or gamified elements to increase participation.

Create your first survey, form, or poll now!

13. Social Media Surveys

More than 5.07 billion people are using social media worldwide in 2024, a number projected to increase to over 5.85 billion in 2025. This makes social media extremely important to marketers and researchers. Social media surveys are a valuable tool for collecting customer feedback and monitoring brand sentiment. Using platforms such as Facebook, Twitter, Instagram, and the new Threads, many companies and organizations send out social media surveys regularly. Because people check their social media accounts quite regularly, it’s a good way to collect responses and monitor changes in satisfaction levels or popular opinion. Read more about the benefits and best practices in our blog on social media surveys.

These surveys often use native tools like Instagram polls, Twitter surveys, or Facebook forms. They provide fast, real-time feedback and can go viral if the topic resonates. Social media analytics also allow segmentation by age, location, interests, and engagement, making it easy to target niche demographics and optimize campaigns.

14. Mobile Surveys

Mobile traffic has now overtaken desktop computers as the most used device for accessing the internet, with more than 54% of the share. Conducting surveys via mobile devices allows researchers to reach respondents wherever they are, making data collection more flexible and efficient. But don’t fret – you don’t have to create an entirely new survey to reach people on their phones or tablets. Online poll makers like SurveyLegend are responsive, so when you create a desktop version of a survey, it automatically becomes mobile-friendly. The survey renders, or displays, on any device or screen regardless of size, with elements on the page automatically rearranging themselves, shrinking, or expanding as necessary. Learn more about our responsive surveys.

15. Mobile App Surveys

Today, most companies have a mobile app. These can be an ideal way to conduct surveys as people have to willingly download your app; this means they already have a level of engagement with your company or brand, making them more likely to respond to your surveys. Mobile app surveys are frequently used as customer experience surveys to assess satisfaction and identify areas for improvement.

In-app surveys can be shown post-purchase, after feature use, or upon app uninstall attempt. This contextual timing helps pinpoint customer pain points or success factors. Integration with analytics platforms like Mixpanel or Firebase enhances tracking user behavior before and after the survey, giving a more complete picture.

16. QR Code Surveys

QR Code or QRC is an abbreviation of “Quick Response Code.” These two-dimensional encoded images, when scanned, deliver hidden information that’s stored in them. They’re different from barcodes because they can house a lot more information, including website URLs, phone numbers, or up to 4,000 characters of text. The recent QR code comeback provides a good opportunity for researchers to collect data. QR code surveys streamline the survey process by making it easy for respondents to access and complete surveys. Place the QR code anywhere – on flyers, posters, billboards, commercials – and all someone has to do is scan it with their mobile device to have immediate access to a survey. Read more about the benefits of QR code surveys.

17. Delphi Surveys

A Delphi survey is a structured research method used to gather the collective opinions and insights of a panel of experts on a particular topic. In this context, research participants are typically experts who contribute their insights anonymously, providing open-ended, qualitative data through multiple rounds. The process involves several rounds of questionnaires or surveys. Each round is designed to narrow things down until a consensus or hypothesis can be formed. One of the key features of the Delphi survey research is that participants are unknown to each other, thereby eliminating influence.

Delphi surveys are ideal for complex decision-making in uncertain or evolving fields like healthcare, tech forecasting, and policy development. Because anonymity is maintained, it removes the pressure of groupthink. Each round refines insights, often incorporating statistical summaries to show consensus levels or divergent opinions.

Create your first survey, form, or poll now!

18. AI Surveys

Artificial intelligence is a new type of survey method. Using AI, researchers allow the technology to ask survey questions. These “Chatbots” can even ask follow-up questions on the spot based on a respondent’s answer. Read more about AI Surveys. By dynamically adapting questions based on previous responses, AI surveys help researchers gain deeper insights into customer motivations and experiences. There can be drawbacks, however. If a person suspects survey questions are coming from AI, they may be less likely to respond (or may respond incorrectly to mess with the AI). Additionally, AI is not good with emotions, so asking sensitive questions in an emotionless manner could be off-putting to people.

Online Surveys: Ideal for Collecting Data and Feedback

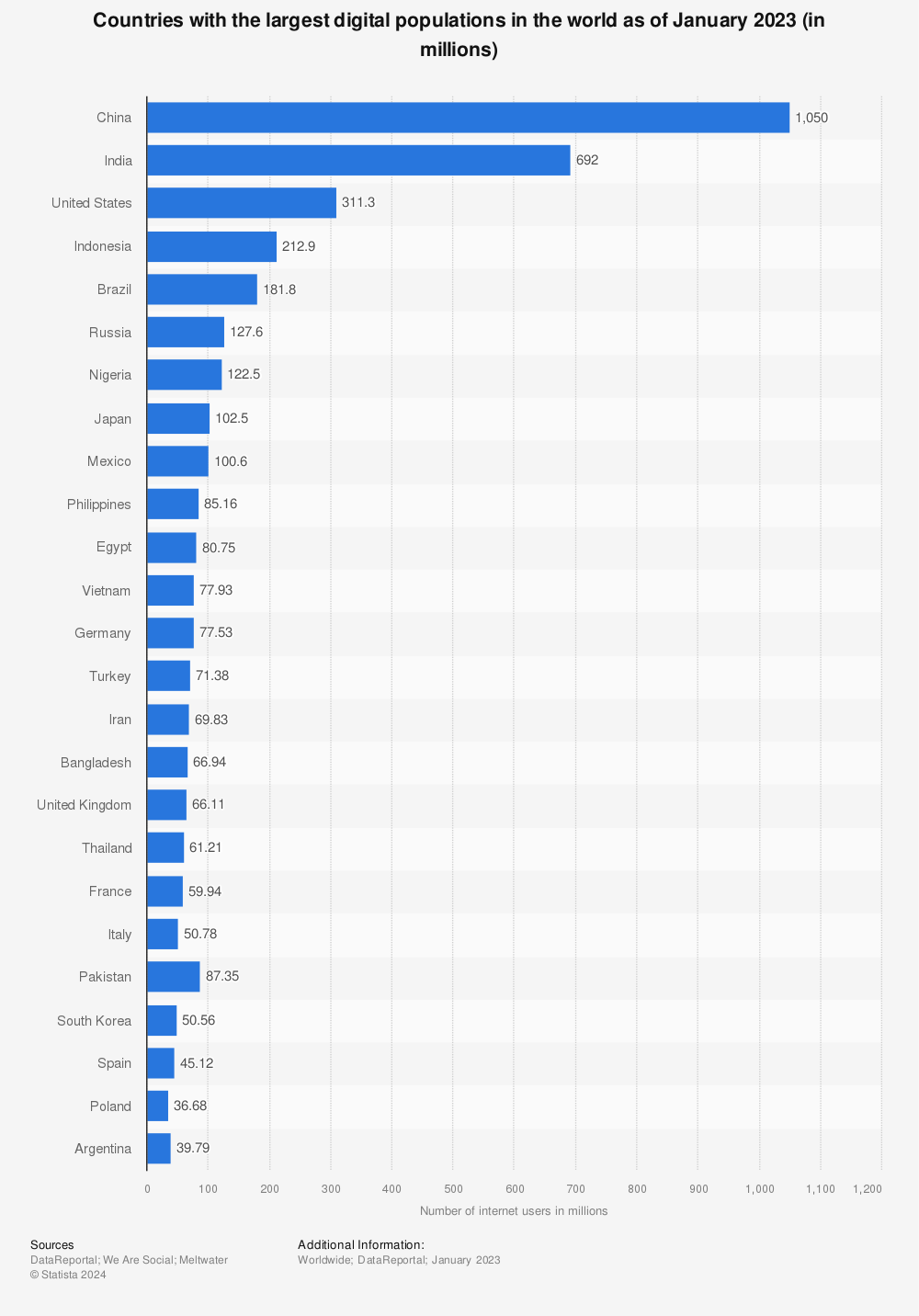

While other options exist, the majority of surveys today are conducted online in one form or another. Online surveys are generally the best way to collect data and feedback, as internet usage, across most countries, is incredibly high! Here’s a look at how many people are using the internet by country. And remember, this is in millions!

The data collected from online surveys can vary depending on the type of survey, the sample size, and the target population. Online surveys often include demographic questions to better understand respondents and use rating scales for quantifiable feedback. They are suitable for both descriptive research and trend analysis, including trend surveys and cohort surveys, which help track changes in opinions or behaviors over time. Online surveys can collect both quantitative and qualitative data, and qualitative feedback and qualitative insights are valuable for understanding customer motivations and experiences.

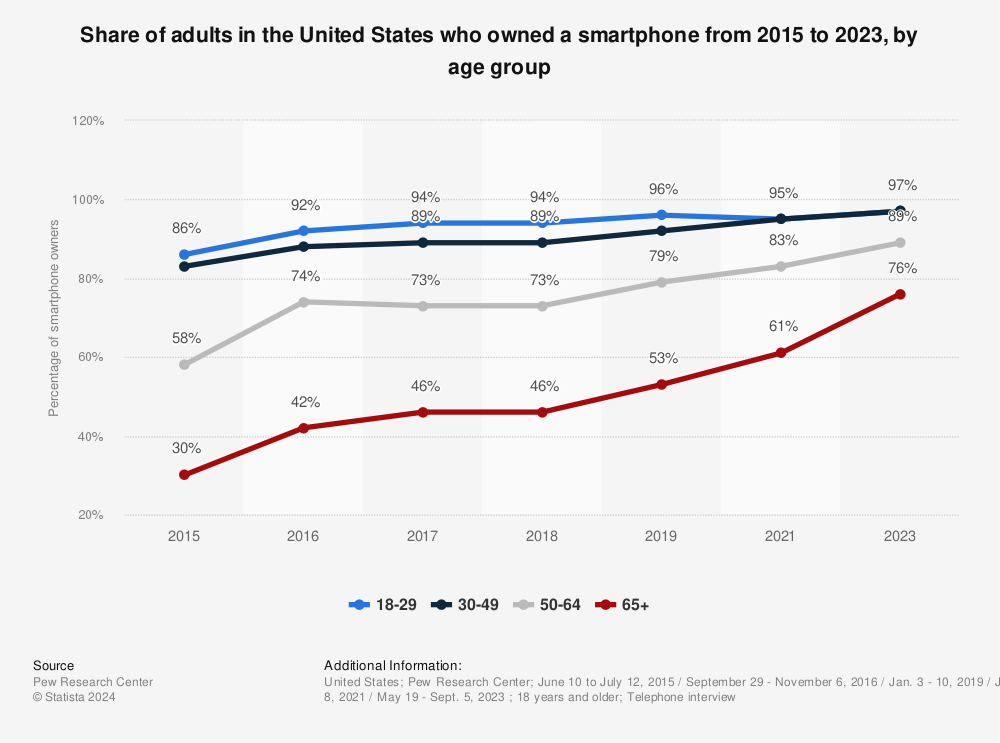

At one time, there was concern that online surveys had an age bias. However, today there is a much better balance between age groups using the internet. According to Pew Research, the share of adults in the United States using the internet are as follows:

That’s not all. People can take online surveys just about anywhere thanks to mobile devices. The use of these devices across age groups is balancing out as well. Check out smartphone use by age group below.

With more and more people accessing the internet through their mobile devices, now you can reach teens while they’re between classes and adults during their subway commute to work. Can’t say that for those other types of surveys!

Online surveys are also extremely cost-efficient. You don’t have to spend money on paper, printing, postage, or an interviewer. This significantly reduces set-up and administration costs. This also allows researchers and companies to send out a survey very expeditiously. Additionally, many online survey tools provide in-depth analysis of survey data. This saves you from having to spend money on further research once the survey is complete.

Create your first survey, form, or poll now!

Conclusion

Researchers have their pick of options when it’s time to conduct research and survey people. Which method you choose may depend upon cost, reach, and the types of questions.

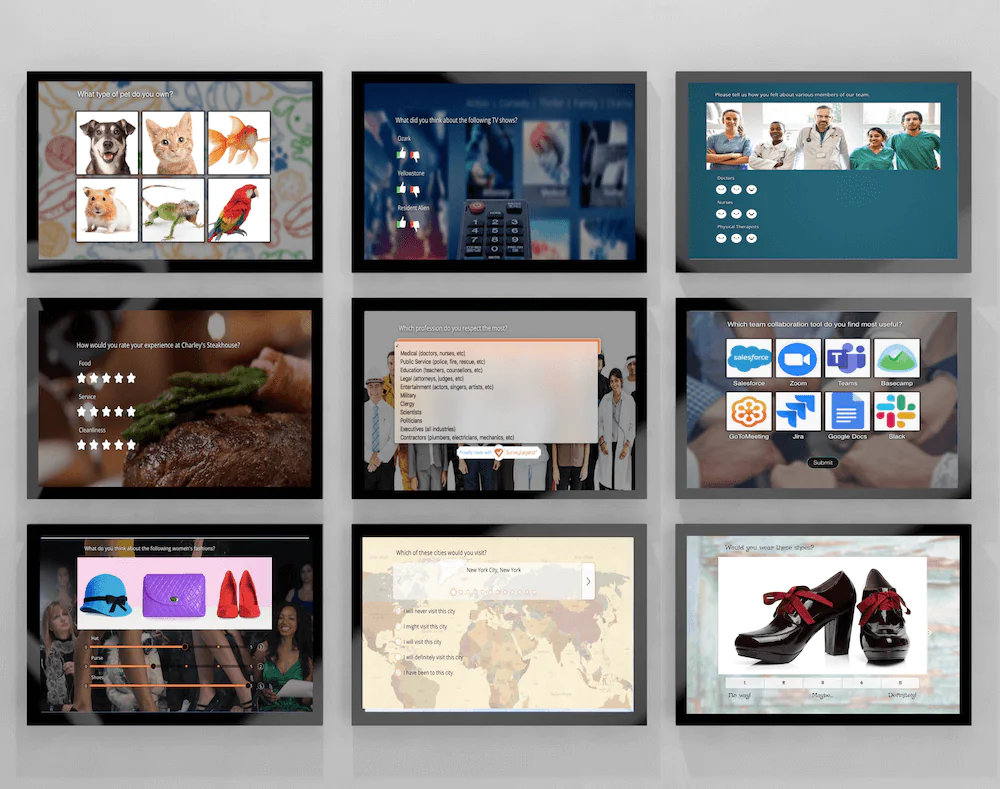

Now, you may be wondering, “Where can I make free surveys?” You can get started with free online surveys using SurveyLegend! Here are a few things that make SurveyLegend the ideal choice for different types of surveys for research (or for fun).

- When it comes to surveys, making it brief is best to keep respondents’ attention. So, SurveyLegend automatically collects some data, such as the participant’s location, reducing the number of questions you have to ask.

- People like eye candy, and many surveys are just plain dull. SurveyLegend offers beautifully rendered pre-designed surveys that will get your participants’ attention – and keep it through to completion!

- Today, most people take surveys on mobile devices. Often surveys desktop surveys don’t translate well, resulting in a high drop-off rate. SurveyLegend’s designs are responsive, automatically adjusting to any screen size.

Frequently Asked Questions (FAQs)

What are the different types of survey methods?

The 10 most common survey methods are online surveys, in-person interviews, focus groups, panel sampling, telephone surveys, post-call surveys, mail-in surveys, pop-up surveys, mobile surveys, and kiosk surveys.

What are the benefits of an online survey?

Benefits of online surveys include their ability to reach a broad audience and that they are relatively inexpensive.

What is a kiosk survey?

Kiosk surveys are surveys on a computer screen at the point of sale.

What is a focus group?

A focus group is an in-person interview or survey involving a group of people rather than just one individual. The group is generally small but demographically diverse, and led by a moderator.