Create your B2C or B2b survey, poll, or questionnaire now!

What is a B2C Survey?

A B2C survey, or business-to-business survey, targets the general public or the end-users who purchase your products or services. While a business entity can sometimes be considered an end-user, it still falls under the B2B umbrella. B2C survey questions are typically related to an experience. For example, “How did you enjoy your stay at our hotel?” “How was the service at our restaurant?” “Would you recommend this product to your friends or family?” B2C surveys typically ask for feedback at the point of sale or the subsequent delivery of the product or service. The survey is directed toward the person who makes the final buying decision, although this could sometimes be two or more different people, usually living in the same household. Their decision-making can range from impulse buying to routine habit buying, or it could be a one-time buy of significant complexity, such as a new home.What is a B2B Survey?

A B2B survey, or business-to-business survey, targets business professionals across any industry. Sometimes, the B2B survey questions are designed to gauge interest in a product or service with the hope of securing purchases; other times, the survey requests feedback in order to improve offerings or solve problems (i.e., a B2B customer satisfaction survey). Although this may not sound that different from a B2C survey (after all, these businesses can or may become consumers of your product or service), this fits squarely into the B2B survey realm. When conducting a B2B survey, it is important to survey multiple levels within the organization. Of course, you want to know what decision-makers have to say since they are ultimately in charge, but you also want to know how the business people who interact with your product or service daily (or who may in the future) feel about things. For example, let’s say you’re surveying businesses on their interest in a new technology product. Of course, you want to know what the CEO thinks, but you’ll also want feedback from the CFO who approves the purchase; the IT Director who will install the technology and the team that will maintain it; and those who will have to work within it, such as human resources, marketers, salespeople, administrators, and so on. You may have a very different reaction based upon who you survey!7 Differences Between B2B & B2C Surveys

1. Methodology

How do you go surveying consumers and businesses? For B2C surveys, any one of the usual market research data collection tools (mail-in or online surveys, telephone or in-person interviews, focus groups, etc.) is all applicable. All you need to do is ensure you’re talking to the most suitable people based on your demographic needs to ensure quality results. For the B2B audience, which is typically much smaller, you may need to employ several of the previously mentioned surveying techniques or a B2B survey panel in order to collect enough responses to arrive at any significant conclusion. That’s because, unlike the general consumer, they may have less time for surveys (and get a lot of solicitation emails). In addition, they may only consider taking a survey during business hours whereas a general consumer may check their personal email any day of the week at any time. So, be ready to send email surveys (and reminder emails), pick up the phone for a chat, or even drop by the business for a face-to-face interview.2. Response Rates

Whereas a B2C survey can be sent out to almost an infinite number of people to achieve the desired amount of responses, B2B surveys are finite, targeting specific businesses in specific industries of a certain size, and only looking at business professionals holding particular titles or roles. That can really narrow down the number of surveys you can send, in turn lowering B2B survey response rates. According to B2B research by Gartner, in a company of 100-500 employees, an average of 7-8 people are involved in a single purchase decision. As a result, B2B surveys need to reflect this by focusing on decision-making units rather than individuals (which is more typical of B2C research). In addition to including a smaller number of participants, B2B surveys target an audience who work in a professional environment where there can be a lot of time constraints or competition for their time. Plus, while the level of interest or overall satisfaction with a product or service may play a part in the questioning, B2B survey questions tend to focus more on business decision-making, processes, and business sales. That complexity makes them take longer to complete, resulting in drop-offs that further reduce B2B survey response rates. Lastly, unlike B2C surveys where rewards benefit the individual, a B2B marketing survey rewards the business as a whole, so there’s often less incentive to complete it. With the average survey response rate falling between 10% and 30%, expect B2B surveys to be on the low end and B2C surveys on the higher end.3. Sample Sizes

This goes hand-in-hand with #2 above. While some B2C surveys can be small in scale if the demographic questions get really specific, researchers in this area generally have an Olympic-sized pool of participants in which to survey. B2B researchers, however, are playing in the kiddie pool. Since the audience is more targeted than a general population sample, there will never be as many respondents available. And, the more specific the survey gets in regard to industry, company size and location, and professional titles, the smaller the B2B survey sample becomes. Because of the smaller sample sizes of B2B surveys and the amount of unreturned or incomplete surveys, it’s less common for researchers to weight a dataset in order to ensure it is representative of an overall sample. Often, researchers go by the “80/20 rule.” This rule places greater weight on the responses of more important and influential respondents.4. “Fun” Factor

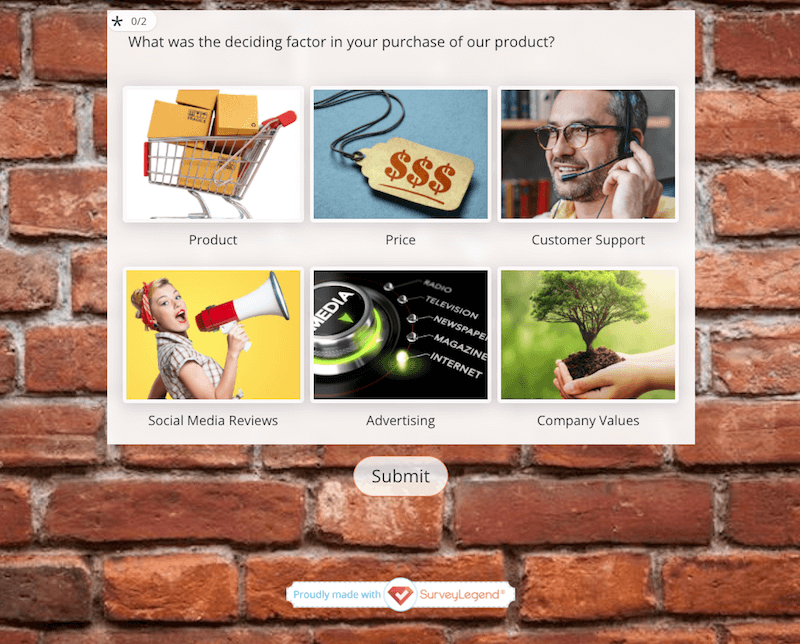

Just how fun should your survey be? That depends on the topic and the audience. Typically, B2C surveys are more “fun,” however, no one likes to be bored. So, if appropriate, inject some “fun” into B2B survey questions too. Basically, do what you can to increase engagement and that will increase response rates (be sure to check out our blog, How to Make a Fun Survey for seven great ideas). One thing to consider is that B2C surveys are usually more emotionally driven. For example, a survey about baby products may use imagery and words to try to tug at new parents’ heartstrings. As a result, an attachment to the survey is formed and they’re more likely to complete the survey and purchase the product. On the other hand, B2B survey takers are more rational and sophisticated in their responses. For example, “lifetime cost” may be a consideration when responding to price, while consumers probably won’t think that far ahead. One way to make a survey more fun and engaging is to use photo surveys or picture polls. This approach can work for B2C or B2B surveys. Take a look at this SurveyLegend survey, which asks a question appropriate for both B2C and B2B audiences. It uses survey visuals as answers to engage, with a brick background alluding to “the building of a relationship.” Learn more about SurveyLegend’s image-based surveys and polls.

Learn more about SurveyLegend’s image-based surveys and polls.

5. Rewards

In B2C market research, survey incentives are generally pretty straightforward, involving discounts, free gifts, and gift cards or cash (in fact, the NCBI reports that in one study a monetary incentive doubled the odds of participants returning a questionnaire). In B2B market research, incentives generally favor the business rather than the individual who is completing the survey. Typical B2B incentives include access to a report or whitepaper, a free demo, a webinar, or exclusive deals.6. Cost

What’s the difference in cost between B2C & B2B surveys? It’s hard to say; it will depend on the number of surveys you send and the surveying method you choose. B2C surveys can be conducted with, potentially, millions of people. Of course, that could cost a fortune if you’re employing interviewers or telemarketers, paying for postage, and offering incentives. B2B surveys, on the other hand, are limited in scope with a smaller number of potential respondents. Therefore, they typically cost less due to the smaller sample size. However, B2B surveys may require additional follow-up in order to gather a representative response, costing additional time and money. So, always be sure to plan for the cost of your surveys to make sure you can achieve the results you want within the budget you have. Thankfully, online surveys cost little to nothing to send!7. Timing

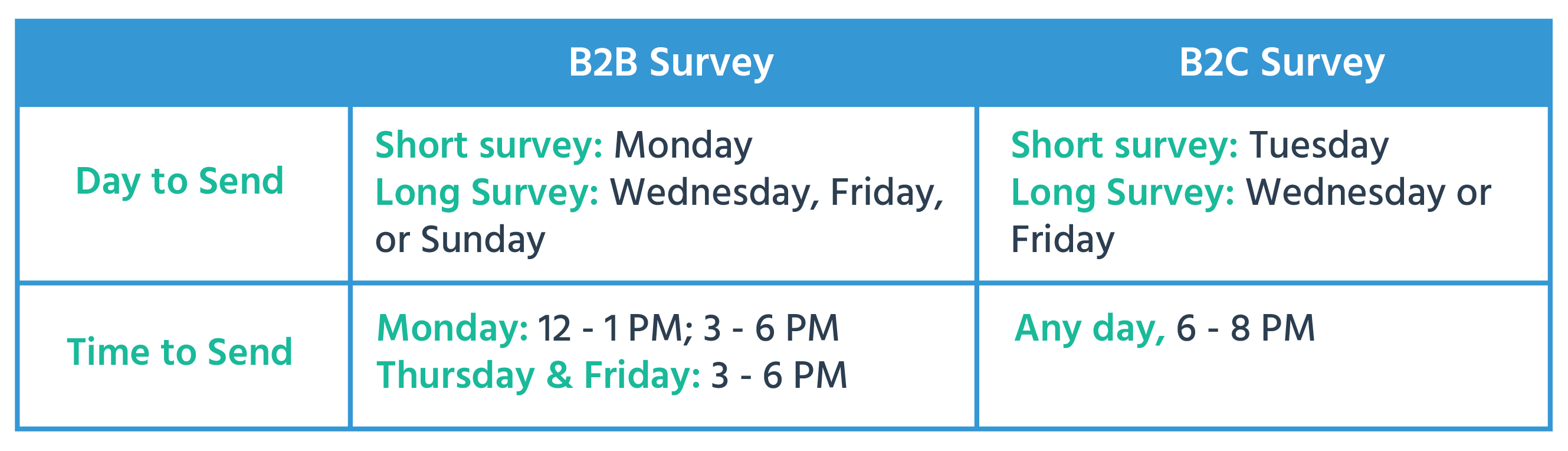

Don’t take a one-size-fits-all approach to sending B2C and B2B surveys online. Research shows that consumers and business people have different email-opening habits. That means the day and time you send them should reflect this. A study from CheckMarket recognizes the difference between B2B and B2C audiences, as well as the length of the survey (short surveys being 15 minutes or less and long surveys being anything more than that). So, consider using this chart as a guide for sending surveys on the right day and time.

Conclusion

The concept of a one-size-fits-all approach will usually not work when it comes to B2C and B2B surveys. In most cases, methodologies, sample sizes, responses rates, costs, timing, design, and incentives will be quite different. So, you’ll want to design surveys that reflect this. Ready to begin? SurveyLegend is your go-to B2C and B2B survey company! We offer a variety of types and styles of surveys, beautifully rendered photo surveys and picture polls, and a high level of security, along with real-time analytics that will give you an insane amount of insight. You can check out some of our B2C and B2B survey examples and templates, or just get started for free now! Do you regularly conduct B2B or B2C surveys? What do you do to make them for engaging? What tips can you share with our readers? We’d love to hear from you in the comments!Create your B2C or B2B survey, poll, or questionnaire now!

Frequently Asked Questions (FAQs)

A B2C or business-to-consumer survey targets the general public and researchers tailor it to various demographics. A B2B or business-to-business survey targets business professionals and researchers tailor it to industry, company size, job title, and so on.